Wealth Management

When you aren't sure of the right path, we're here to help guide you on your way.

Call 250-245-6371 to book your appointment.

UPDATE: The issue has been resolved.

Our switch provider is currently experiencing service degradation which is affecting ATM and POS transaction for multiple financial institutions. We appreciate your patience while they resolve the issue.

Our 2024 Full Consolidated Financial Statements are now available to view and download. Alternatively, you can view all of our Financial Reports.

When you aren't sure of the right path, we're here to help guide you on your way.

Call 250-245-6371 to book your appointment.

When you aren't sure of the right path, we're here to help guide you on your way.

Call 250-245-6371 to book your appointment.

Investing that fits(It's not just wishful thinking.)Ask us about RRSPs, TFSAs, and other tailored investment solutions designed to fit your unique goals, risk tolerance, and life stages perfectly. With a commitment to transparency and personalized service, we'll help make your financial dreams come true - no glass slipper required. |

|

|

Investing that fits(It's not just wishful thinking.)Ask us about RRSPs, TFSAs, and other tailored investment solutions designed to fit your unique goals, risk tolerance, and life stages perfectly. With a commitment to transparency and personalized service, we'll help make your financial dreams come true - no glass slipper required. |

Million of Assets Under Administration

Advisor with

Years Experience

LDCU Financial Management Formed

Years Ago

Ensure a smooth retirement by following this guide.

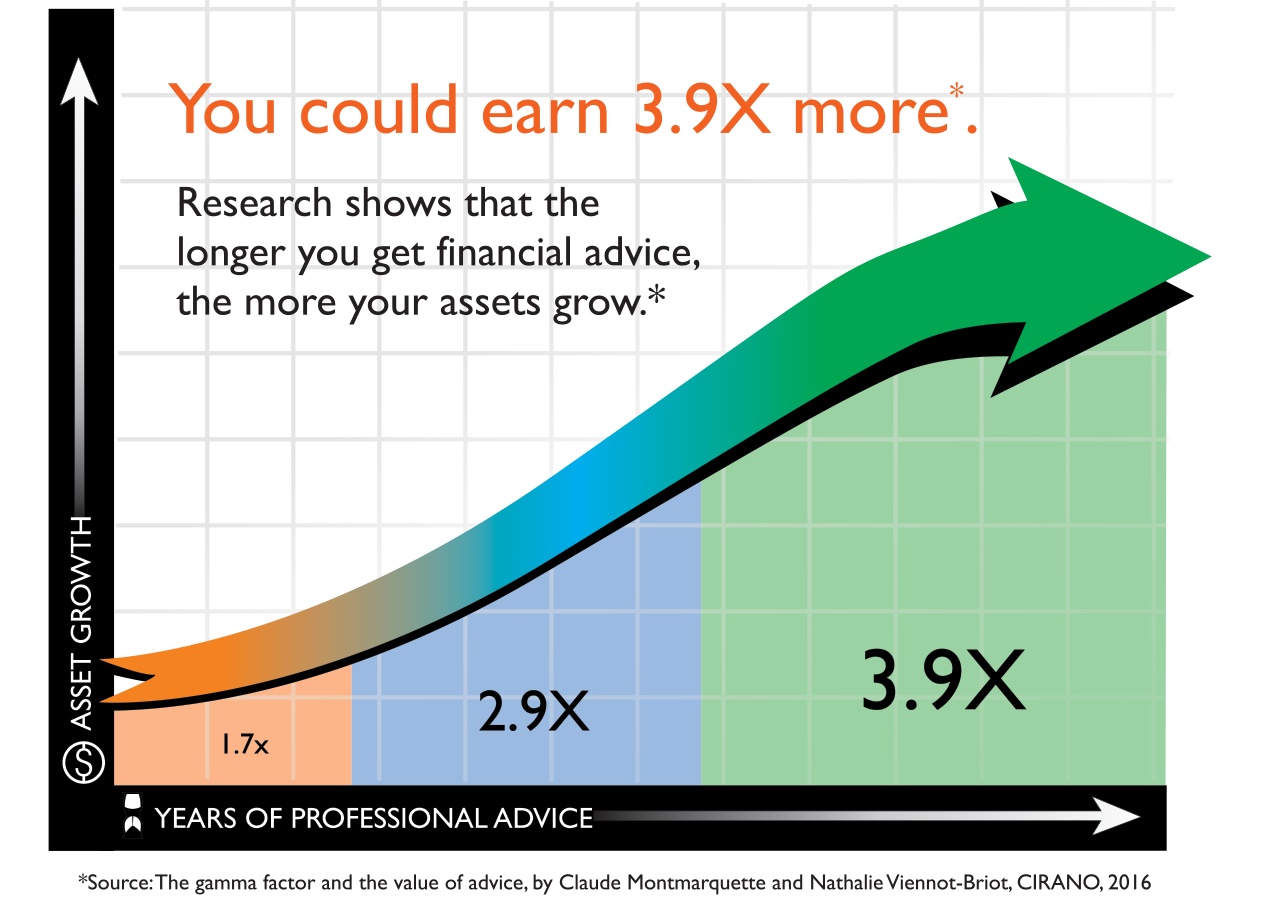

Your Financial Advisor at LDCU Financial Managment is here to guide you on the right path. We will work with you to create a personalized wealth management strategy tailored to your unique goals.

Your Plan will be designed based on your goals and needs, built with best-in-class investments, and continually monitored to ensure it keeps you on track toward the future you desire.

There are tax implications to each and every element of your complete Wealth Plan, but we can deploy a whole arsenal of tactics to minimize your tax burden.

Your LDCU Financial Advisor can help and is insurance licensed to offer or discuss insurance in a plan that strengthens and safeguards your family’s financial security.

Develop a Retirement Plan that capitalizes on the opportunities of today and is sustainable over the long term.

By incorporating your philanthropic goals into our wealth management process, we ensure your wealth and values can leave a lasting impact.

You can’t take it with you, but you can decide where it will go and how smooth the transition will be.

Looking ahead to the future, planning for retirement is crucial. At LDCU, we're here to help. Check out our retirement calculator on our website to easily estimate your savings needs and plan for a secure future.

Looking ahead to the future, planning for retirement is crucial. At LDCU, we're here to help. Check out our retirement calculator on our website to easily estimate your savings needs and plan for a secure future.

The Canadian Retirement Income Calculator will provide you with retirement income information including the Old Age Security (OAS) pension and Canada Pension Plan (CPP) retirement benefits. You will need this information to populate the Annual Pension From Government field on the retirement calculator.

View the Canadian Retirement Income Calculator on the Government of Canada website to calculate your estimated Annual Pension From Government.

Mutual funds are offered through Assante Financial Management Inc. ®Assante is a registered trademark owned by Assante Wealth Management, and is used under license.

LDCU Financial Management Ltd. offers mutual funds through Assante Financial Management Ltd. ("AFM"), a registered mutual fund dealer and Member of the Canadian Investment Regulatory Organization. Life insurance products and services are offered through Assante Estate and Insurance Services Inc. ("AEIS"). For more information on AFM and AEIS please visit http://www.assante.com.

Commissions, trailing commissions, management fees and expenses, may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the prospectus or fund facts and consult your advisor before investing.